By Mike Kurinets, Chief Investment Officer

Loan Prices Dropped at the End of November.

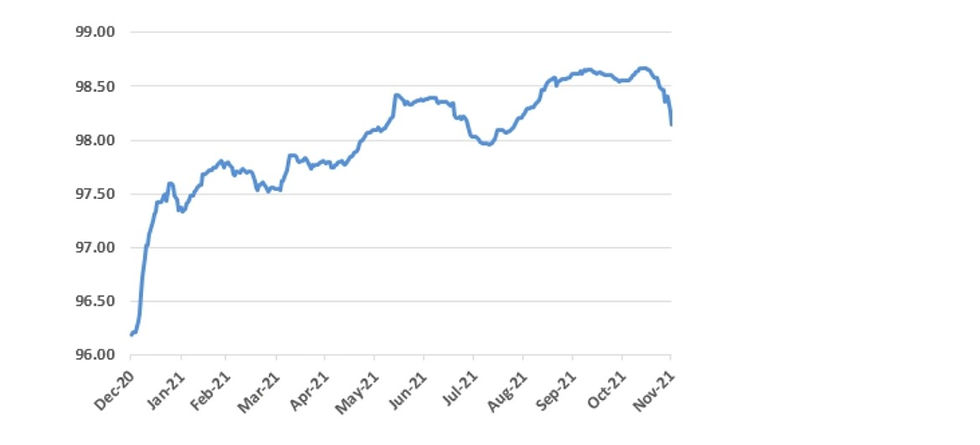

In November, prices in the leveraged loan market ended the month lower by 0.47 points [*1]. Year-to-date loan prices are now up 1.4 points. However, it’s worth focusing on what drove loan prices in November.

By the middle of November, loan prices were 0.1 points higher on the month, and the loan market felt like it was going to be another month of low volatility. During the second half of the month, however, the neutral sentiment began to change. Concerns over inflation and Fed policy pushed loan prices lower and the modest gains of the first half of the month were reversed. However, the real sell-off in loan prices came during the last 3 days of the month, as warnings about the new Covid-19 variant, Omicron, began to dominate the headlines. During those last 3 days, loan prices plummeted 0.4 points. The selloff was across the entire sub-investment grade rating spectrum, from BB down to CCC loans.

Below is a recap of loan price performance since the end of 2020:

What happened in the CLO market during November?

1: Norinchukin (“Nochu”) Bank, the largest holder of AAA CLO tranches in the world, announced that it is re-entering the CLO market.

This is noteworthy not only because Nochu purchases large blocks of AAA tranches, but also because it does so at spreads that are typically several basis points tighter than the rest of the tier-1 AAA CLO market [*2].

When Nochu initially announced in 2019 that it would be taking a step away from the CLO market, there was concern that without their presence, AAA CLO spreads would widen. Those concerns turned out to be misplaced because, as Nochu temporarily stepped out, other large institutions quickly took their place. Most notably JP Morgan and Wells Fargo increased their presence, as did other investors, and new issue AAA bonds became a more broadly syndicated product.

With Nochu coming back into the CLO market [3], we don’t anticipate that other participants will take a step back, and it’s possible that the additional demand for AAA paper could push current spreads tighter. Despite the significant increase in CLO issuance this year, the large supply of CLOs was met with equally large demand and CLO spreads have largely held firm. Following Nochu’s lead, it is likely that other Japanese buyers will also once again have an appetite for CLO AAA paper. It’s reasonable to expect that CLO AAA spreads may tighten in 2022 which, all else being equal, would have a positive effect on CLO equity securities, since tighter spreads on CLO debt tranches translate into increased cash flows to CLO equity securities.

2: Morgan Stanley and JP Morgan have both forecast large CLO issuance in 2022, and predict that CLO equity securities will outperform other assets.

Morgan Stanley identifies CLO equity securities as the best investment in structured products next year. JPM also chooses CLO equity securities as their top pick [*4].

MS, Barclays and JPM forecast 2022 US$ CLO issuance to be in the $130 to $160 billion range. For comparison, YTD US$ CLO issuance in 2021 has been $176 billion [*5] and market consensus is that CLO issuance will be light in Q1:2022. The high CLO issuance forecasts suggest that once the market adjusts to SOFR in early 2022, issuance of CLOs is expected to resume its current pace for the rest of the year.

The expected slow start to CLO issuance in 2022 means that only the very large managers, with access to captive capital [*6], will be able to print deals right away. The issue for most CLO managers will be LIBOR/SOFR basis risk.

CLO equity investors may not be comfortable with early 2022 vintage CLOs, which will have leveraged loans largely indexed to LIBOR [*7], while the CLO liabilities will be indexed to SOFR.

While this concern may be true for most CLO managers, it’s likely that the largest CLO managers, which control significant amount of captive capital, will be the ones originating new CLOs in early 2022, since they can use captive capital to purchase CLO equity securities regardless of any concerns over basis risk.

CLO investors, on the other hand, are concerned that lower issuance volumes in 2022 will bring fewer opportunities to deploy capital. The solution appears to be that investors have been willing to deploy significant capital in 2021. As a result, the CLO market witnessed record new issuance in November with only slight evidence of investor fatigue or spread widening on CLO liabilities below the AAA level.

3: The new issue market for CLOs is essentially closed for the rest of 2021.

The typical time it takes from when a CLO is priced, which is when debt and equity tranches trade, to when it CLO is closed, or when the trades settle and money changes hands, is six weeks. This is the time it typically takes to finalize the documentation and for the CLO manager to purchase additional collateral to round out the deal [*8].

However, it is possible for that six-week time period to shrink to four weeks or less. While we do anticipate some CLO managers will price CLOs after Thanksgiving, in anticipation of closing the deals in 2021, these will be exceptions and the new issue CLO market is essentially closed for the remainder of this year.

4: The CLO equity market experienced all-time record issuance in November.

An astounding $26.4 billion of new issue CLO equity securities was originated in November. This is the largest monthly new issue volume in the history of the CLO market. The other three monthly issuance records were also set in 2021 in August, September and October [*9].

Spreads on CLO liabilities were slightly wider in November across the mezzanine tranches

After CLO liabilities widened in March in response to the unprecedented supply of CLOs starting in February, spreads contracted in April. CLO spreads have remained largely unchanged since then with a slight tightening of AAA spreads in August.

In November, we finally saw some widening of spreads in CLO liabilities. The magnitude of widening does not appear to be material in light of the multiple consecutive months of record CLO issuance volumes, but it does indicate that investors, who have consistently absorbed all supply of CLOs, finally pushed back on what felt like ‘unending supply’ of CLOs.

November's US CLO new issue activity

While November set an all-time record for monthly new issue volume [10], the CLO market is now effectively done printing new deals for the rest of this year.

Footnotes

[*1] - Based on our tracking of 909 CLOs

[*2] - Tier-1 market refers to CLO managers that typically print new issue deals at the tight end of the range for AAA

[*3] - Creditflux reported that Nochu’s AAA holdings dropped from $70 billion at the start of 2021 to $50 billion by end of Q2:2021.

[*4] We have not yet seen forecasts from other major dealers.

[*5] According to S&P Global Market Intelligence

[*6] Captive capital is a reference to monies that CLO managers have raised to invest in the CLO equity tranches of the CLOs that these managers bring to market. This used to be referred to as risk-retention capital, when risk-retention was the law in the U.S.

[*7] As of October 29th, nearly the entire $1.2 trillion leveraged loan market was indexed to LIBOR and only a very small number of loans were indexed to SOFR

[*8] Often, by the time a CLO is closed, as much as 80% of the loans have already been purchased and the remaining loans have been identified.

[*9] S&P Global Databank

[*10] All data are sourced from S&P Global Market Intelligence. Both Broadly Syndicated Loan (BSL) and Middle-Market (MM) CLOs are included. On average in 2021, BSL CLOs have represented approximately 90% of total US$ CLO new issue volume.

Forward Looking Statements

Some of the statements contained in this presentation constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. The forward-looking statements contained in this presentation reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances, many of which are beyond our control, that may cause our actual results to differ significantly from those expressed in any forward-looking statement. Statements regarding the following subjects, among others, may be forward-looking: the use of proceeds from our public and private offerings (as the case may be); our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and advance rates for our target assets; our expected leverage; general volatility of the securities markets in which we invest; our expected investments; effects of hedging instruments on our target assets; rates of leasing and occupancy rates on our target assets; the degree to which our hedging strategies may or may not protect us from interest rate volatility; liquidity of our target assets; impact of changes in governmental regulations, tax law and rates, and similar matters; availability of investment opportunities; availability of qualified personnel; estimates relating to our ability to make distributions; our understanding of our competition; and market trends in our industry, interest rates, real estate values, the debt securities markets or the general economy. While forward-looking statements reflect our good faith beliefs, assumptions and expectations, they are not guarantees of future performance. Furthermore, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes. This presentation contains statistics and other data that has been obtained from or compiled from information made available by third-party service providers. We have not independently verified such statistics or data.

Disclaimers

This confidential document is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities or partnership interests described herein. Interests in Capra Credit Management, LLC (“Capra”) partnerships may not be purchased except pursuant to the partnership’s relevant subscription agreement and partnership agreement, each of which should be reviewed in its entirety prior to investment.

Comments